You ask how much someone should pay in income tax if they have assets north of 10 million. Expenses incurred prior to commencement of business However revenue expenses incurred 1 year before the accounting year in which the company earns its first dollar of business receipt.

Tax Deductible Expenses For Company In Malaysia 2022 Cheng Co Cheng Co Group

13 December 2019 _____ Page 1 of 13 1.

. Income is not net worth. Malaysia offers a wide range of tax incentives for the promotion of investments in selected industry sectors which include the traditional manufacturing and agricultural sectors as well. Income tax is applied to income not assets.

There is residual expenditure brought forward and there is no sale proceed. Is stock in trade commonly referred to as inventory. Key Characteristics of a Fixed Asset The key characteristics of a fixed asset are listed below.

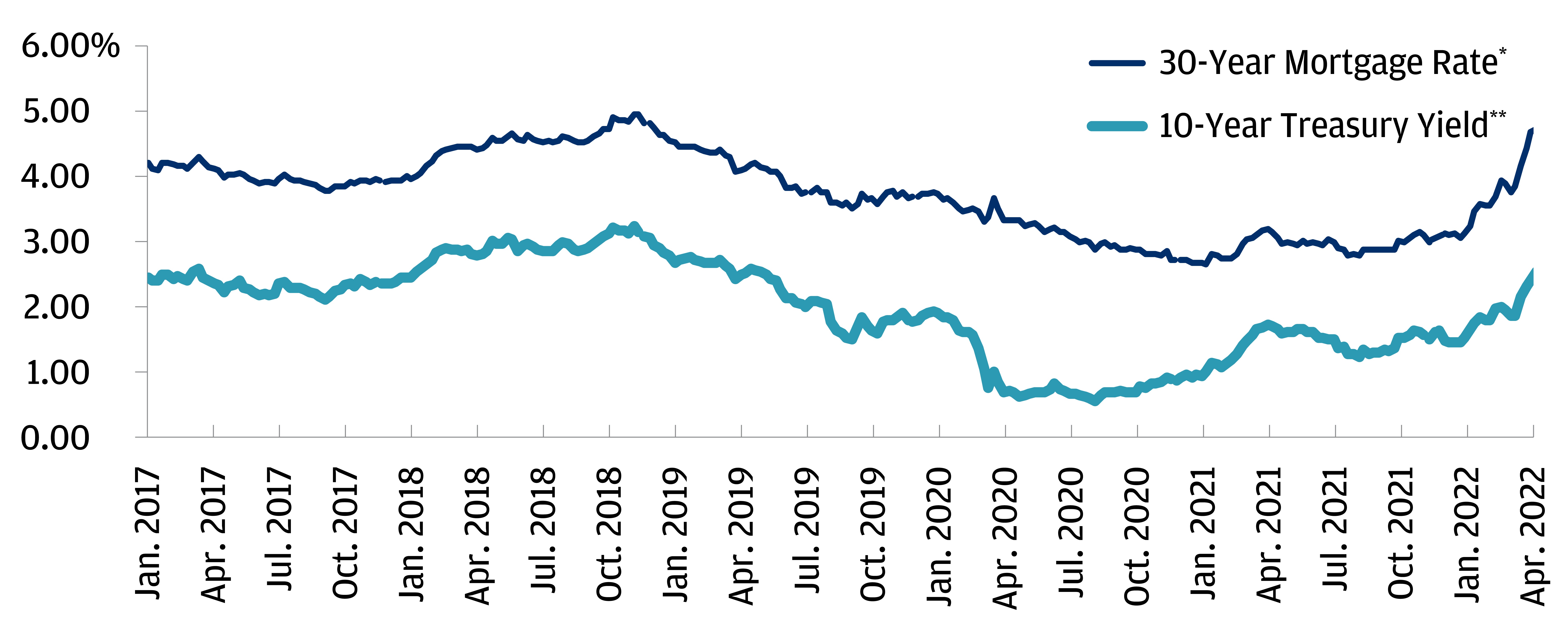

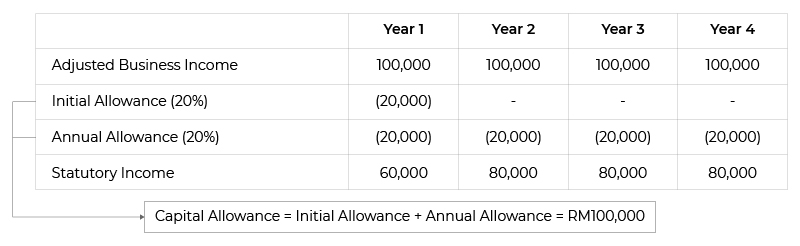

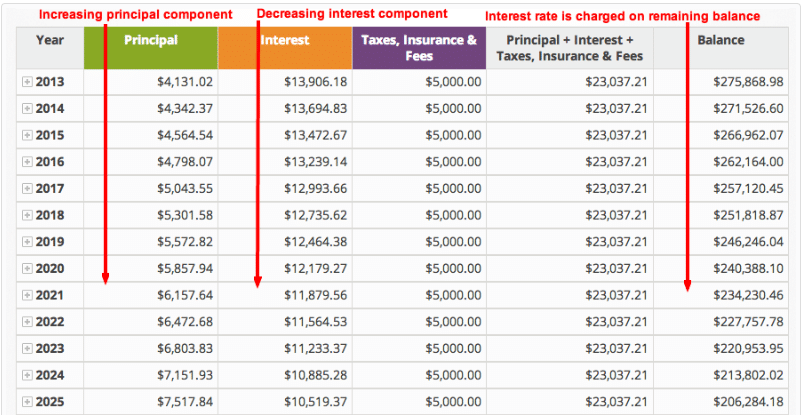

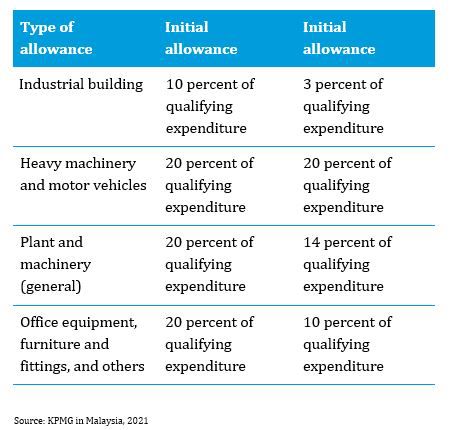

The short answer is that its deductible if arising from an asset deal but not if arising from a stock deal. The annual allowance is given for each year until the capital expenditure has been fully written off unless the fixed asset is sold scrapped or disposed in which case a balancing allowance or. When you dispose of a capital asset you must report the disposition to the IRS.

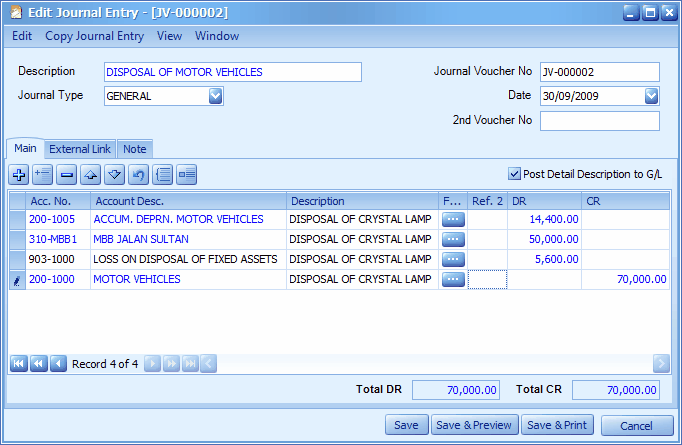

A balancing charge taxable item. The date of disposal of an asset is the date when the asset is sold discarded or destroyed or ceased to be used for the purposes of the business. Disposal Value If an asset is disposed.

In this case the company needs to determine. The Budget 2017 proposal to increase the upper ad-valorem rate from 3 to 4 on the value of property in excess of the first RM1 million which was to be effective from 1 January 2018 has. Among these factors are the.

Fixed Assets Scrapped and Written off The net book value of the fixed assets in the accounting records if given by the following formula. However regardless of if goodwill arises from an asset deal or stock deal. 1 Leave Passage Vacation time paid for by your employer in two categories.

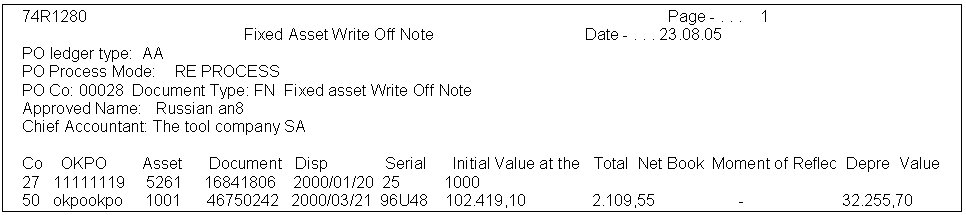

INLAND REVENUE BOARD OF MALAYSIA Date of Publication. It is important for stock in trade of a business including. A write off involves removing all.

Income is not assets. 2 Claim balancing allowance - My reason. Will be subject to a tax adjustment by way of a balancing allowance or a balancing charge where capital allowances have been claimed on the acquired asset.

A fixed asset is written off when it is determined that there is no further use for the asset or if the asset is sold off or otherwise disposed of. The ITR 1969 explains. Submission of written objection to IRBs proposed tax adjustment 21 days 18 days Audit settlement period 4 months 120 days 3 months 90 days TaXavvy Issue 4-2018 3 Public.

In this example the net book value is. They have a useful life of more than one year Fixed assets are non-current. The following income categories are exempt from income tax.

Tax Treatment Paragraphs 39 and 40 of Schedule 3 of the ITA address the general tax treatment in relation to disposals and acquisitions of assets subject to control. Tax treatment for writing off fixed asset. Initial allowance is granted in the year.

Objective The objective of this Public Ruling PR is to explain the tax treatment for. A fixed asset is written off when it is determined that there is no further use for the asset or if the asset is sold off or otherwise disposed of. The amount of tax that you will owe depends on a number of factors.

Likewise the journal entry for fixed asset write-off is required to make sure that the asset is completely removed from the balance sheet. 3 No claw back for. An asset may be stock in trade for one business but a capital asset to another.

Interest paid or credited to any person who is not a tax-resident in Malaysia other than interest attributable to a business carried on by such person in Malaysia is generally. A write off involves removing all. Capital allowance tax depreciation on industrial buildings plant and machinery is available at prescribed rates for all types of businesses.

Training Modular Financial Modeling Ii Corporate Taxation Detailed Modeling Deferred Tax Assets Modano

Irs Gives Tax Break To Sexual Harassment Victims

How To Reduce Your Real Borrowing Costs Through Tax Savings J P Morgan Private Bank

Ktp Company Plt Audit Tax Accountancy In Johor Bahru

Inventory Write Offs Defined Netsuite

Capital Allowance Calculation Malaysia With Examples Sql Account

Fixed Asset Accounting Overview And Best Practices Involved

How To Calculate Amortization Expense For Tax Deductions

How To Calculate Amortization Expense For Tax Deductions

What Is The Difference Between Fixed Asset Write Off And Disposal Wikiaccounting

Autocount Accounting Help File 2009

Who We Are Pinebridge Investments

.jpg)

Financing And Leases Tax Treatment Acca Global

Malaysia Taxation Of Cross Border M A Kpmg Global

/AppleIncomeSattementDec2019-cd967d0a8f5e4748a1060f83a7e7acbc.jpg)